Many people think that if they have an irregular income they cannot do the same things as those who have a regular income. In fact I have heard many people say that you simply cannot budget if you have an irregular income because you do not know what you will have coming in from month to month.

While you cannot predict what your actual income will be for the month on your irregular income you can smooth out the cash flow that you get and force yourself to have a ‘regular’ income.

To this you must first set up a budget.

Yes you do need a budget set up as the first step to turning your irregular income into a regular cash flow. In order to do this you need to first track your spending. Once you have a good idea of how much you spend in one month then you can create a budget based on your spending.

Ideally you will set up a budget based on the regular cash outflows that occur every month. There will also be an allowance for irregular cash outflows that do not occur every month.

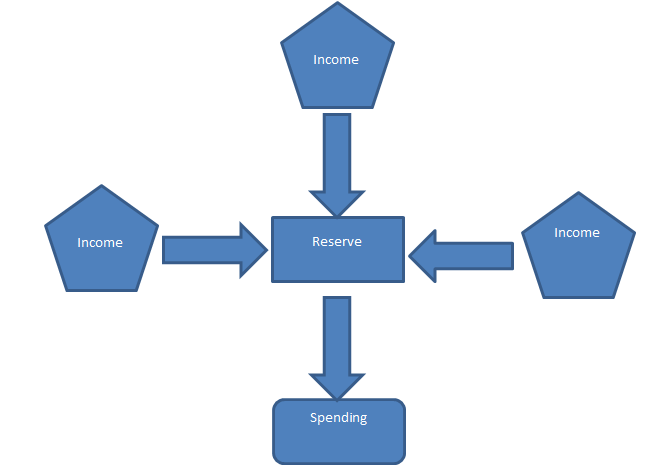

As the diagram shows you funnel all of your irregular income into an account, generally a savings account and let that be the accumulation pool. Then you let that account funnel a fixed amount every month based on your budget that was created from the spending tracker you completed earlier.

Every month you send what you have budgeted for to the spending account and use that to do the various things that you do on a monthly basis. This will include things like:

-paying bills

-buying food

-saving

-paying utilities

-fun

The rest of the money will stay in your savings reserve to build up to pay for the next regular monthly budgeted amount. If your regular spending budget is less than the amount in the reserve plus any inflows then your reserve will begin to grow over time.

The benefit of this process is that it smooths out your cash flows every month. This gives you the peace of mind where you know that if your cash inflow is not as big as expected in one month then you can access the reserve for a cash injection into your spending account and you will not starve or have bills go unpaid.

Go ahead and take that first step and turn your irregular income into a regular cash flow so you can get on with the rest of your life.

Recent Comments