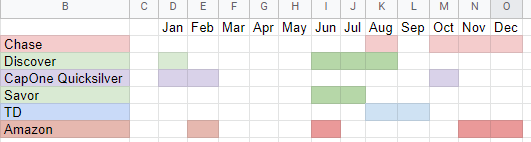

This year I tried tracking monthly credit card usage for fun. This was easy to set up in a spreadsheet and just looked at what months I used each card.

(If you are not reading this post at www.howisavemoney.net or in your feed reader, it may have been stolen from my site.)

The main reason for doing this is to make sure I use every card through the year. If you do not use your cards they may be targeted for deactivation for non use by many card companies. I also just wanted to get a visual of when I really did use the cards.

I listed each card I use on a regular basis and listed out the months. Then I gave each card a color and updated the month when I used the card.

How I Track Usage

Each card is updated in one of two ways. Either I update the month when (1) I add the card to my wallet or (2) I make the card the default on a website. I check the bonuses on cash back available for each card and compare them to see which gives the most bang for my buck.

My every day card is the Citi card which has an unlimited 2% cash back on all purchases. This card is used for all bills like phone and electricity, since they do not count as ‘purchases’. I get the flat 2% for those transactions and do not have to track categories or change out cards.

That card is used every month so it did not make sense to include it in the graphic. From the image you can see that my usage is pretty well distributed through the year with each card. While Citi is my daily use card it is not the only card used because some cards offer 5% cash back on certain purchases.

During the months when Discover gave 5% on gas I used that card in my wallet and got gas. Otherwise the Citi card would be in my wallet for the other months.

There were some months where I forgot to track or forgot to switch out. I want to keep a handle on monthly credit card usage, so I will try to make a better effort to keep up with it in 2023.

Recent Comments